Accor

The French do it better.

Hotels…

Most people have a highly romanticized version of hotels - crisply made beds, dashing concierge at your beck and call, the glamor and glitz of a beautiful hotel lobby.

The reality? Running a hotel is anything but glamorous. Think about the endless toilet bowls that need scrubbing, guests sneaking out in the middle of the night to dodge the bill, and, worst of all, the dreaded bed bug infestation. Even if you have operations under control, the real challenge is getting “heads in beds.” How do you even get people to know you exist? It’s a tough business to run…

Enter Hotel Management Companies

There’s a simple solution: hand over the reins to a hotel management company. You can sign a management agreement with Hilton and they’ll handle every aspect of your hotel. Then, you can sit back and (hopefully) watch the dividend checks roll in. Beyond being a one-stop solution for aspiring hoteliers, these companies are among the best businesses in the world.

The Business of Hotels

Scalable, asset-light business: When Joe Hotelier signs a hotel management agreement, the fees start rolling in. There are technical service fees for advice on bringing the hotel up to brand standards, booking fees for every reservation made through the operator’s platform, IT fees, brand marketing fees, and more—it’s a constant stream of income. In fact, I doubt 99% of hotel owners fully realize the extent of the fees they’re paying.

For Hilton, this model is ideal. No capital expenditure or additional headcount is needed, and voilà, another hotel is added to their network. It’s a highly scalable, low-capital business model.

For the hotel owner, it’s still a better deal than going it alone. From advice on uniforms, IT systems, fire safety, door locks, to menu design, hotel management companies provide comprehensive SOPs to ensure every detail is covered.

Network effects: Many of today’s top tech companies thrive on network effects—think Facebook, Amazon, or Uber. Hotel management companies are no different. The best analogy to a hotel management company is Uber: hotels act as drivers, and travelers are the riders. The denser and more efficient the network, the greater its usage and success. Add in loyalty points that every banker or consultant you know collects religiously, and you have a business that, in our humble view, far surpasses Uber.

On the supply side, unlike Uber, hotel owners commit to decade-long agreements, adopting your SOPs and IT systems. Removing a hotel management company would be like ripping out the spine with the brain attached—good luck with that!

This creates a highly robust, two-sided network business with substantial economies of scale. For example, individual hotels might pay up to 18% of each reservation to platforms like Expedia, whereas Hilton-affiliated hotels could pay as little as 8%. So, when Hilton charges 5-6% for bookings generated through its system, it’s a win-win.

Brand business: Hotel companies are a collection of brands, but unlike LVMH, the individual hotel owners fund the marketing, brand building, and loyalty programs. This makes the model even more advantageous, as the brand grows while the costs are shouldered by the owners. Every logo that goes up on a third-party-owned asset only further builds a brand owned by the hotel company.

Stable, contractually recurring revenue: Decade-long agreements, combined with the fact that rebranding hotels is both costly and challenging, create a subscription-like, recurring revenue model with a powerful competitive moat.

As a result of these compelling business dynamics, some truly great companies have been built in the hotel industry.

Accor: Introduction & History

Most investors we know love Hilton, and some favor Marriott, but Accor is rarely mentioned. We’ve taken a contrarian stance.

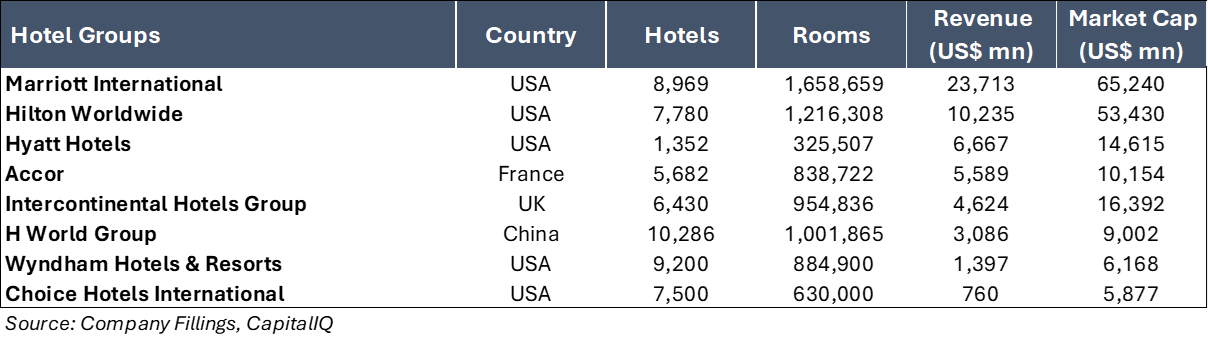

First, a quick introduction: Accor owns, manages, and franchises 5,613 hotels worldwide across 45 brands, ranging from luxury to economy. Listed in Paris, it is the largest hospitality company in Europe and the fourth largest globally. In 2023, Accor reported revenues of US$5.6 billion, with an operating income of US$800 million and a net income of US$700 million.

Why We Like It:

Geographic exposure: Accor is a leader in both Asia and Europe, two of the most promising regions for hotel growth. In Asia, China and India each have populations of 1.4 billion, but branded hotel penetration remains low—26% in China and only 11% in India. By comparison, the U.S. has a 73% brand penetration, offering less room for expansion. Even Europe, with 45% penetration, is a fragmented market dominated by independent hotels, providing even greater growth potential than the U.S.

Category exposure: Accor has the lowest exposure to luxury compared to its peers, and it’s laser focused on expanding this segment. This gives the company a long runway for revenue per available room (RevPAR) growth.

Franchise vs. Managed: Let’s flip an old saying on its head—"Teach a man to fish, and you feed him for a lifetime." Franchise models are great for scaling quickly, and IHG and Hilton have excelled at this. However, franchise models offer limited lock-in. If a hotelier is proficient at running motels, it hardly matters if the sign says Holiday Inn or Days Inn. But with managed hotels, the dynamic shifts. When a hotel owner relies entirely on the management company, they never learn to operate independently. This creates a deep dependency, making the management company almost impossible to replace.

Cheap valuation, downside protection: Accor is trading at multi-year low valuations, the lowest in its global peer group. Currently, Accor trades at approximately 17x price-to-earnings (NTM) and 11x EV/EBITDA (NTM), while global peers trade at 24-34x PE and 15-18x EV/EBITDA. Accor’s business is likely to see mid-teens EPS growth, with shareholders benefiting from an 8% annual cash yield through buybacks and dividends.

Potential catalysts

Divesting AccorInvest: AccorInvest, which owns 701 owned or leased hotels, was spun off from the Accor group in May 2018. Accor retains a 30% ownership stake, valued at EUR 609 million on Accor’s books, and plans to sell this stake in the near future.

M&A Target: Accor makes an attractive acquisition target for its peers due to its market capitalization and complementary global footprint.

Next week, we’ll dive deeper into relative valuation and why the valuation gap between Accor and its peers may be justified.