In our last post, we laid the foundation for understanding Accor, Europe’s largest hospitality group. Now, it’s time to dive deeper. In this follow-up, we’ll analyze Accor’s operational structure, financial metrics, and how it stacks up against competitors.

Let’s start with an overview of Accor:

Accor’s Transformation: From Asset-Heavy to Asset-Light, More Luxury, and More Global

Over the past decade, Accor has fundamentally transformed itself. Shifting from an asset-heavy model, where it owned many of its hotels, to an asset-light approach has allowed the company to expand without the capital-intensive burden of property ownership. This shift has also seen Accor expand its presence in the luxury and lifestyle segments, as well as grow its global footprint.

Key highlights of Accor's transformation:

Asset-Light Model: The transition from owning hotels to a predominantly asset-light model, relying on franchising and management contracts, has been a game-changer. In 2013, only 50% of Accor’s hotels were asset-light. Today, that figure stands at over 95%. This shift has freed up capital and allowed Accor to focus on scaling its operations.

Luxury and Lifestyle Focus: Accor has successfully increased its luxury and lifestyle hotel segment, with fees from these hotels rising from 11% of total fees in 2013 to 34% today.

Geographical Diversification: Accor has made significant strides in expanding beyond Europe, with non-European business volume rising from 26% in 2013 to 61% today.

This transformation has allowed Accor to concentrate on what it does best: managing and franchising hotels across the globe while minimizing the risks associated with property ownership.

For investors, this means: higher margins, lower capital requirements, and greater flexibility to scale. Accor’s managed and franchised hotels now generate a 73% EBITDA margin, far outperforming the legacy-owned hotel segment. This operational shift hasn’t just made Accor more agile—it has unlocked substantial earnings potential.

Geographic Diversity: A Global Advantage

What sets Accor apart from competitors like Marriott and Hilton is its truly global footprint. While Marriott and Hilton are heavily concentrated in the Americas, Accor has strategically expanded its presence across Europe and the Asia-Pacific (APAC) region. Currently, 44% of Accor’s hotels are located in Europe, while 34% are in APAC, a region with notably low branded hotel penetration, representing a key growth opportunity. This geographic diversity not only allows Accor to tap into underdeveloped markets but also serves as a hedge against economic volatility in any single region, providing stability that competitors may lack. Moreover, Accor’s significant non-Americas exposure could make it an attractive acquisition target for rivals seeking to expand their international presence.

Luxury & Lifestyle: Accor’s Growth Engine

Accor’s push into the luxury and lifestyle (L&L) segment is one of the most compelling aspects of its transformation. Historically known for its economy and midscale offerings, Accor has steadily built its presence in the high-margin luxury space. Today, L&L accounts for 34% of fee revenue, up from just 11% in 2013, with a projection to hit 40% by 2027.

With 47,000 rooms in the luxury pipeline, representing 41% growth, Accor’s ambition is clear: it intends to compete head-on with Marriott’s Ritz-Carlton and Hilton’s Waldorf Astoria. This expansion into luxury not only boosts margins but also strengthens Accor’s brand equity on a global scale.

The Brand Advantage

The shift from independent hotels to branded chains is accelerating globally. Independent hotels face significant costs and challenges in upgrading their tech infrastructure and investing in digital marketing to reduce reliance on Online Travel Agencies (OTAs).

Branded chains, on the other hand, benefit from superior technology and command a much higher percentage of direct bookings—at a 4:1 ratio in the U.S. compared to independent hotels.

Moreover, branded hotels offer key advantages: stronger brand recognition, superior management practices, and loyalty programs that drive repeat business, leading to higher occupancy and room rates. These factors, combined with reduced reliance on costly OTAs (independents pay nearly double), make affiliating with a branded chain a strategic move for long-term success.

As this trend continues, the hotel industry is shifting toward more branded properties to capitalize on these advantages and meet evolving consumer demands. Large players like Accor are well-positioned to capture this movement and benefit from the increasing preference for branded hotels.

Operating Metrics: Room for Improvement

Accor’s RevPAR, ADR, and occupancy rates lag behind its competitors, largely due to its higher exposure to the economy and midscale segments, which account for 73% of its rooms. However, since 2017, Accor has demonstrated higher revenue growth than its peers, signaling a strong ability to execute on its strategy.

AccorInvest: Key to Unlocking Value for Accor

AccorInvest, spun off in 2018, holds 701 owned or leased hotels, primarily in Europe, and represents a significant portion of Accor’s real estate exposure. While Accor retains a 30% stake in AccorInvest, it has expressed clear intentions to sell this stake, potentially unlocking substantial value.

Here’s why selling the stake in AccorInvest could be transformative:

Balance Sheet Optimization: Proceeds from the sale could strengthen Accor’s balance sheet, fuel growth in its luxury segment, or be used for shareholder returns through buybacks and dividends.

Debt Reduction: AccorInvest is set to dispose of €1.7 billion in assets by 2025, reducing its debt load. An exit by Accor would free it from associated liabilities, increasing financial flexibility for expansion, particularly in high-growth markets like Asia.

Focus on L&L: Accor has been moving aggressively into the luxury and lifestyle segments, which offer much higher margins and more consistent revenue streams. Divesting from AccorInvest, which primarily consists of economy and midscale hotels.

A Trusted Management Team with a Clear Path Forward

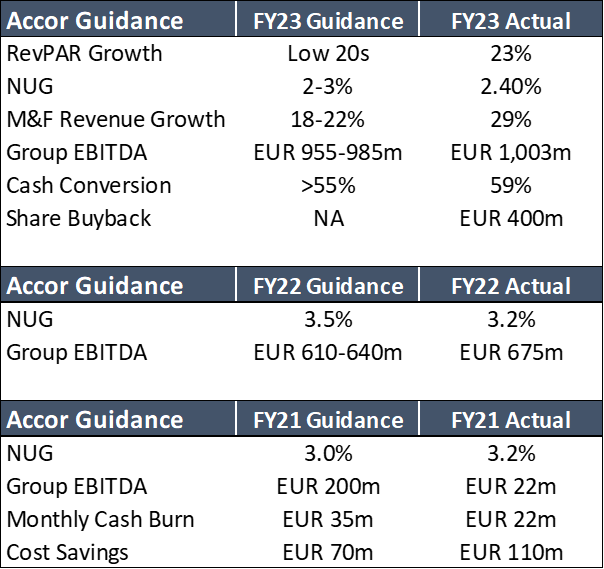

Accor’s management has a track record of delivering on its promises, and its guidance of 9-12% EBITDA growth CAGR through 2027 appears realistic, especially given the company’s current trajectory.

Historical Guidance vs Actual:

Current Guidance:

Valuation: Unwarranted Discount

Despite all the positive developments, Accor remains one of the most undervalued players in the hospitality market. Trading at just 11x EV/EBITDA, it is significantly cheaper than Marriott (16x) and Hilton (19x).

Over the past five years, Accor’s stock has been relatively flat, while its peers have posted double-digit gains. Yet, with Accor’s projected mid-teens EPS growth and its plan to return 7-8% annually to shareholders through buybacks and dividends, this discount seems hard to justify. In short, we are long!

In our next post, we’ll explore Accor’s relative valuation and whether the market is undervaluing the company’s long-term potential.