There’s been a fair bit of interest in Atour $ATAT in recent months, so we thought to dive in a bit deeper and build on this great primer by East Asia Stock Insights on the following topics:

ADR, Occupancy rates & RevPAR

Retail Business Overview & Valuation

Hotel Business Valuation Comparison

Update on Capital Allocation - Dividends!

ADR, Occupancy rates & RevPAR

Beast Mode! Not only is Atour growing revenue at a 31% CAGR (2x market leader H World), but it’s doubled its margins leading to a 60% EBITDA CAGR.

If we take a further look into what is driving the revenue and margin, you can see that Atour is absolutely blowing away the competition on a Revpar basis - the most important metric for hoteliers.

This is even though Atour is opening hotels ~2x faster than H World (there is a ramp up period for new hotels before they can stabilize their occupancy).

Overview of Retail Business

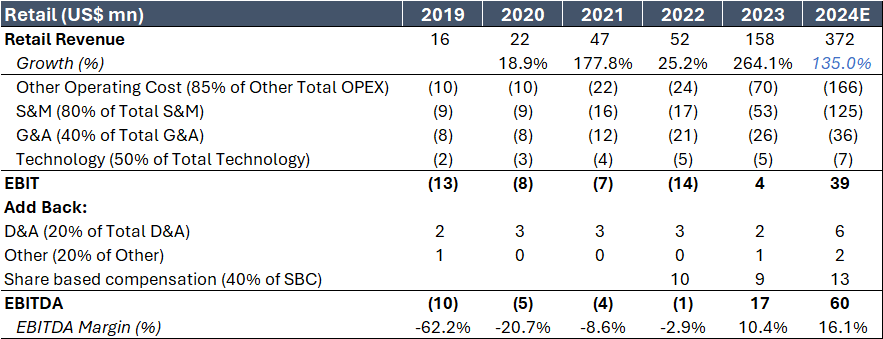

Atour’s retail business has been on an incredible journey, quickly becoming a key player in the lifestyle market. Specializing in sleep-related products, over 90% of its retail offerings revolve around helping customers get a better night’s rest, with pillows alone making up a whopping 60% of its sales. One of Atour’s star products, the “Planet Pillow,” has gained such popularity that it now holds a 10% market share in China, according to Zhiyan data. According to our estimates, Atour’s retail business is expected to bring in around US$372 million in revenue for FY24—a remarkable 135% year-over-year increase.

U.S. retail comps typically trade at an EV/EBITDA multiple of 10-18x while Atour’s Asian peers trade at an EV/EBITDA multiple of 8-15x. Forecasted to double in size in FY24, Atour’s retail segment should have a valuation premium, but we are probably getting it for close to free!

Hotel Business Valuation Comparison

Atour’s hotel business valuation presents a compelling case. The company is competitively positioned among global peers, which trade at price-to-earnings (P/E) multiples ranging from 17x to 33x, and EV/EBITDA multiples between 11x and 20x. What truly sets Atour apart is its remarkable growth trajectory, with a 30% revenue CAGR and an astounding 60% EBITDA CAGR from 2019 to 2023. This extraordinary performance—despite the so-called "China discount"—arguably justifies a valuation significantly higher than its peers, such as H World.

Capital Allocation

In August 2024, Atour announced its new Annual Dividend policy, committing to distribute at least 50% of its net income from the previous financial year over the next three years. The Board declared a cash dividend of $0.45 per American depositary share (ADS), implying a dividend yield of 1.6% despite its incredible growth profile, speaking to the asset light nature of the hotel management business .

In sum, we are bullish and we are long! But please remember, this is NOT investment advice.