MGM Resorts:

MGM Resorts International is a leading global hospitality and entertainment company with a portfolio of properties and digital businesses across the United States and Asia. The company generates revenue through gaming, hotels, entertainment, dining, conventions, and digital wagering.

MGM is comprised of 31 Destinations Worldwide

Las Vegas:

MGM’s Las Vegas properties are the core of its business, including Bellagio, ARIA, MGM Grand, and Mandalay Bay. Las Vegas contributes a significant portion of the company’s earnings, with over half of revenue coming from non-gaming sources such as hotel rooms, conventions, dining, and live events. MGM holds a 40% market share on the Strip and continues to grow through partnerships, including a recent deal with Marriott that delivered 660,000 room nights in 2024. The company also leads in sports and entertainment partnerships, hosting UFC events, boxing, and collaborating with local sports teams.

Over the last three decades, the Las Vegas Strip has seen its GGR grow over fourfold. In this time, MGM Resorts has shifted from being the owner of a single notable property to becoming one of the most influential player on the Strip. Through acquisitions, the development of large-scale resorts, and diversification into entertainment and sports, MGM has established a significant presence in the hospitality and gaming industries.

MGM Resorts' Las Vegas Properties

Regional Casinos:

MGM operates seven regional properties in the U.S., which generate steady cash flows. These properties contribute $1.1–1.2 billion in annual EBITDAR, offering stability with minimal capital requirements. While growth is modest, these casinos provide diversification and reliable earnings outside of Las Vegas.

MGM China (Macau):

In Macau, MGM operates two integrated resorts MGM Macau and MGM Cotai. The company has increased its market share from 8% in 2018 to 16% in 2024, supported by a 36% increase in gaming tables. Mass market demand has driven a 28% increase in net revenues in 2024. MGM is investing further in expanding premium gaming areas and converting standard rooms into luxury suites. The company is seeking a $2 billion loan to support these expansions and refinance debt. Macau remains a key growth market as tourism and economic activity recover.

MGM Japan – the only licensed Casino in Japan

MGM, through a 50/50 partnership with Orix Corporation, is developing a $10 billion integrated resort in Osaka, Japan. Approved in April 2023, the project will feature a casino, luxury hotels, a 3,500-seat theatre, and 400,000 square feet of convention space. It is expected to generate $3.6 billion in annual revenue, primarily from gaming. Japan aims to increase annual international visitors from 30 million pre-COVID to 60 million by 2030, positioning this project for significant long-term value creation.

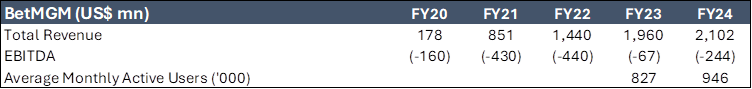

BetMGM:

BetMGM, a 50/50 joint venture with Entain, is a leading U.S. online gaming and sports betting platform, operating in over 30 states. BetMGM holds a 14% market share in online sports betting and 22% in iGaming. The U.S. digital gaming market is projected to exceed $40 billion by 2030.

BetMGM’s Valuation Potential: A $5 Bn Opportunity?

In 2024, BetMGM’s iGaming business generated $424 million in EBITDA, while sports betting remains in investment mode. Management expects the business to reach $500 million in positive EBITDA soon. At a 10x multiple, BetMGM could be valued at $5 billion, with MGM’s 50% stake worth $2.5 billion.

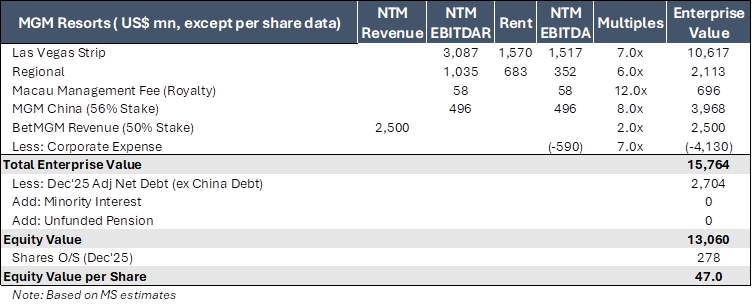

SOTP Valuation

The SOTP valuation of MGM Resorts, using the EV/EBITDA method and segment-based multiples, shows that MGM is currently trading at a notable discount.

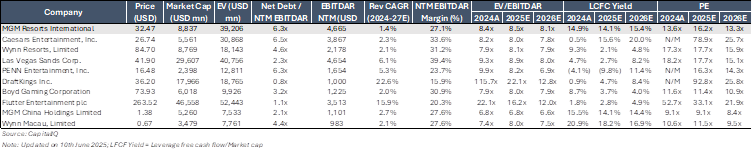

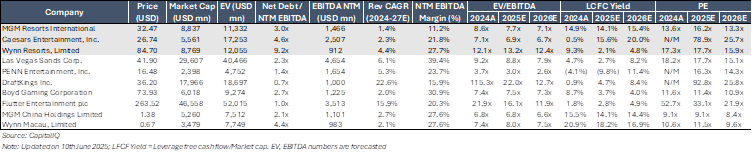

Comps Valuations

MGM Resorts trades at an 8.1x EV/EBITDAR compared to US peers at 6.9-8x. In terms of P/E ratio, MGM Resorts trades at 13.3x, while peers like Penn trade at 14.3x, Wynn at 15.9x, and Las Vegas at 15.1x.

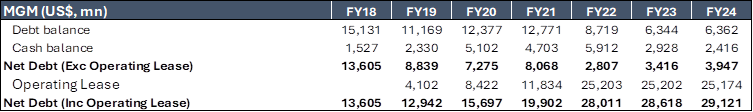

MGM leverage

MGM Resorts International's financial structure is significantly influenced by its lease obligations, driven by its expansive real estate portfolio and transition to an asset-light strategy. The company has executed sale-leaseback transactions for several flagship properties, resulting in long-term lease agreements with predominantly fixed payments and annual rent increases of 2-3%. Excluding lease liabilities, MGM's net debt stands at ~ $4 bn, while including them, it totals around $29 bn.

Valuations (Excluding China operations and before real estate leases)

MGM Resorts (excluding China operations and before real estate leases) trades at 7.1x EV/EBITDA. In comparison, its peers trade at 6.7x for Caesars (also before real estate leases) and 12.4x for Wynn (excluding China operations and before real estate leases).

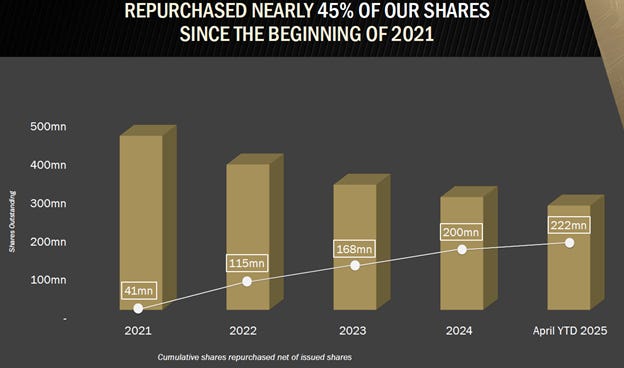

Share Repurchase:

Since 2021, MGM Resorts has significantly returned cash to shareholders through share repurchases. They have invested ~$8.9 bn from 2021 to 30th April 2025, reducing shares outstanding by ~45%. In 2024 alone, MGM Resorts repurchased ~32 mn shares for $1.4 bn. As of December 31, 2024, they still have $826 mn available under their ongoing repurchase plan.

MGM intends to continue share repurchases under its existing buyback plan. Since December 31, 2024, MGM repurchased nearly 15 million shares for about $494 million in Q1 2025 and purchased another 8 million shares till 30th April for $215 million. On April 30, 2025, the Company announced a new $2 billion stock repurchase plan, supplementing its existing November 2023 program. At the current share price of ~$32.5, MGM could potentially repurchase up to 61 mn additional shares, reducing the total share count by roughly 20%.

The table below illustrates the potential impact if MGM continues share repurchases totalling $1 bn per year over the next three years. Assuming a share price of $30, the company could buy back ~100 mn shares, further reducing the total shares outstanding by roughly 33%.

Investment thesis

MGM Resorts offers a combination of steady cash flows from Las Vegas and regional casinos, growth from Macau’s recovery, significant future value from its Japan resort project, and high-margin, capital-light growth from its BetMGM digital business. Management continues to return excess capital to shareholders through aggressive share repurchases.

At current valuations, the company trades at a discount to peers, with future upside driven by Macau recovery, Japan development, digital gaming growth, and ongoing capital returns.

IAC’s commentary for MGM

IAC stake in MGM: IAC first invested in MGM in 2020, purchasing a 12% stake for around US$1 bn. In August 2022, IAC increased its stake by purchasing an additional 1.19 mn shares for $41.7 mn. With MGM share repurchases over the last few years, IAC’s stake in MGM has increased to ~23%

IAC management on MGM: MGM is recognized as a well-managed company with a commanding 40% market share in the vital Las Vegas market. It maintains strong hotel occupancy rates and resilient customer relationships, facing no major technological disruptions. Looking ahead, MGM is expanding globally with a $10 bn resort in Osaka, Japan, and strengthening its digital gaming arm, BetMGM. Despite its complexities, the company is viewed as undervalued and continues strategic stock buybacks, with Chairman Barry Diller emphasizing its status as a "forever asset" and hinting at potential increases in ownership.