Trip.com: The winner in Asia’s travel market

Part I

Imagine a Chinese tech giant that defies the infamous "996" work culture (9 a.m. to 9 p.m., six days a week) and goes a step further by offering an annual cash bonus of RMB 10,000 for each newborn child—every year from the child’s first birthday until they turn five. Is this a company thriving in spite of its unconventional culture or because of it?

Founded in 1999 and listed on the NASDAQ in 2003, Trip.com Group (TCOM) is the dominant player in China’s online travel agency (OTA) market, commanding >50% market share.

Our investment thesis for TCOM is simple: it offers unparalleled exposure to the fastest-growing travel markets in the world—China, India, and Southeast Asia—while capitalizing on the sheer scale of Chinese travelers as the local market leader.

First, Why Travel?

Asia is home to some of the fastest-growing economies globally, driven by rising incomes, increasing consumer confidence, and the secular trend of outbound tourism. Travel spending is highly correlated with GDP (see chart below), giving TCOM a runway that could extend decades.

Despite macroeconomic challenges, China’s domestic travel market has shown remarkable resilience, continuing to grow rapidly. Domestic tourism has been supported by government initiatives to boost consumption. Meanwhile, international travel is rebounding from a historically low base following years of stringent pandemic restrictions. With Chinese travelers representing one of the largest outbound tourism markets globally pre-COVID, the potential for recovery is immense. The dual growth engines of domestic and international travel position companies like TCOM to capture outsized gains in both segments, benefiting from increased volumes and higher-value itineraries abroad.

While artificial intelligence will transform countless industries, no algorithm can replace travel. As consumers increasingly prioritize spending on experiences over material goods, travel will remain one of the most enduring and sought-after activities.

What is an online travel agency (OTA)?

OTAs serve as aggregators for virtually all travel-related bookings, including hotels, flights, rental cars, trains, attractions, and packaged tours. Instead of searching across multiple websites to compare hotel prices or booking flights, hotels, and attraction tickets through different providers, OTAs offer a one-stop solution. Think of them as the "search engine" for travel, providing unparalleled convenience and value to travelers.

While transportation—flights and trains—is relatively commoditized with transparent pricing and limited differentiation, OTAs aspire to enable users to manage their overall travel plans on a single platform. The bulk of OTAs revenue comes from accommodation bookings, where choice and comparison play a far larger role.

Before the internet, hotel brands were synonymous with quality assurance. Staying at a Ritz-Carlton, for instance, guaranteed a consistent experience. But the internet and social media have fundamentally changed the decision-making process. With just a few clicks, travelers can access thousands of reviews, photos, and detailed insights about any hotel. Today, platforms like Airbnb, Booking.com, Expedia, and Trip.com have built brands as recognizable and trusted as traditional hotel chains like Marriott or Hilton.

Travelers typically have two options for booking accommodation:

Direct: For those loyal to specific hotel chains—such as frequent travelers accumulating points with Marriott, Hilton, or Accor—direct booking through the hotel’s website or app is often the go-to option.

OTA platforms (i.e. Trip.com): For everyone else, OTAs offer the easiest way to browse, compare, and book hotels. With vast selections, robust reviews, and dynamic pricing tools, OTAs empower travelers to find the best deals with minimal effort.

Similarly, hotel owners face two primary options when launching a property. They can partner with a global brand like Marriott or Hilton, gaining the advantages of a well-established name, comprehensive marketing, and an extensive distribution network. Alternatively, they can choose to operate independently. However, regardless of the path they take, all roads ultimately lead to reliance on OTAs like Trip.com.

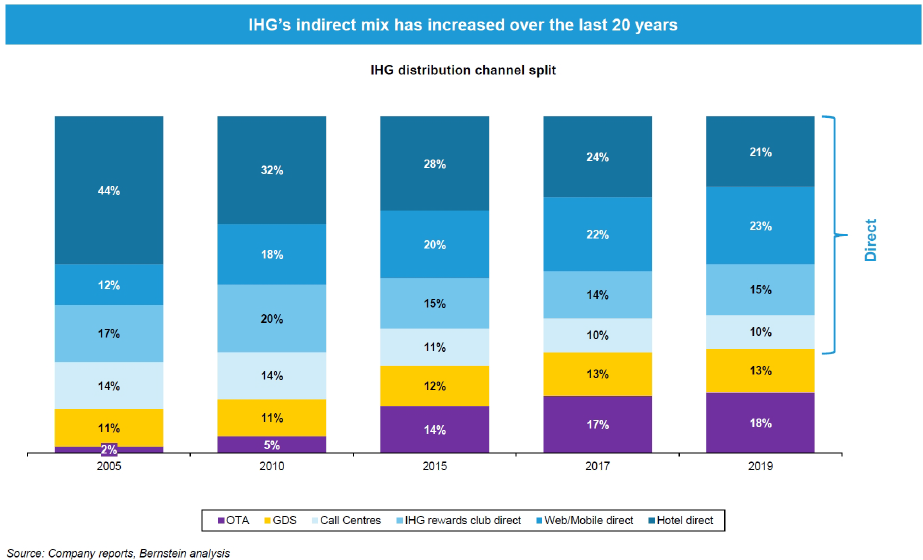

The rise of OTAs, coupled with the abundance of accessible information, has diminished the dominance of traditional hotel brands. In its place, OTAs have reinforced their role as critical tools for price discovery, enabling travelers to make more informed decisions based on real-time comparisons and transparent pricing.

Online Travel Agencies (OTAs) are solid businesses built on two-sided networks, aggregating demand from individual travelers on one side and hotels on the other. However, it’s important to be clear eyed that while OTAs are strong businesses, they can be replicated, as evidenced by the growing number of OTAs in the market (think Meituan and Tokopedia). That said, OTAs are highly cash-generative, with strong margins and impressive returns on investment. Their scalability allows them to thrive in a rapidly growing travel market, capitalizing on both demand and supply without the burden of owning physical assets.

OTA Market Overview:

Investors typically think of Expedia and Booking.com when discussing OTAs, as the two dominant players in the Western world. While we agree that these are good businesses, we believe Trip.com is uniquely positioned to benefit from Asia’s surging travel demand, a trend that will unfold over the coming decades.

What Is Trip.com Group?

Trip.com Group is leading global OTA. With roots in China, the company has expanded its operations to become a major player in the global travel industry. Its operations are divided across four major brands: Ctrip, Qunar, Trip.com, and Skyscanner, each targeting distinct customer needs and geographies.

Ctrip is the cornerstone of the company’s success in the Chinese market. As the leading OTA in China, Ctrip provides a wide range of services, including hotel and flight reservations, tour packages, business travel management, and curated travel-related content.

Qunar complements Ctrip in China by focusing on travel meta-search. Founded in 2005 and acquired in 2015, Qunar caters primarily to price-conscious travelers and solidifies Trip.com Group’s stronghold in the domestic travel market.

Beyond China, Trip.com is the group’s global-facing flagship brand, launched in 2017. It competes with Expedia and Booking Holdings by offering a seamless platform for booking flights, hotels, trains, car rentals, and vacation packages. Available in 24 languages and 35 currencies, Trip.com operates across 39 countries. Trip.com is one of the fastest growing OTAs globally.

Skyscanner, founded in Edinburgh in 2003, was acquired in 2016. Skyscanner is a global travel meta-search platform focused on flights and is available in 35 languages across 52 countries. Skyscanner attracts 100 million monthly app users.

With this diverse portfolio, Trip.com Group employs a dual-market strategy to dominate both domestic and international travel sectors. In China, the combination of Ctrip.com and Qunar provides a formidable ecosystem that caters to a wide range of customer preferences, from luxury travelers to budget-conscious users. Internationally, Trip.com and Skyscanner enable the group to challenge established players like Expedia and Booking Holdings, leveraging cutting-edge technology, multilingual support, and an extensive global network.

China, India & Beyond

TCOM holds two key advantages over other OTAs:

Access to China’s Market and Bargaining Power. Chinese tourists are one of the dominant forces in international tourism, and TCOM can leverage its deep connections within China to negotiate better terms with partners. The sheer size of China’s travel market gives Trip.com a unique advantage in securing favorable agreements, particularly as Chinese outbound travel continues to grow (market of >1 trillion).

Native Access to China’s Travel Market. A broad trend is the retreat of Western companies with China becoming more self-reliant and closed off to foreign businesses. TCOM , as a native player, has a distinct advantage in accessing China’s travel market—an edge that foreign competitors like Booking.com lack. At the same time, many foreign travelers are not familiar with Chinese competitors like Fliggy or Meituan, leaving Ctrip well-positioned to capture a large share of the inbound travel market as it recovers.

TCOM is also well-leveraged to the growth in India through its 49% stake in MakeMyTrip (MMYT). India is widely recognized as the "next China," with a population of 1.6 billion and a per capita GDP that is 40% of China's. This presents a long-term tailwind for travel demand in the region. As the Indian middle class grows and travel becomes more accessible, TCOM stands to benefit significantly from its stake in MMYT.

In Southeast Asia, Trip.com has been a significant share gainer, rapidly expanding at the expense of Expedia and other local OTAs. Over the past eight years, Trip.com has increased its market share by a staggering 10x.

Trip.com is even taking share aggressively in non-traditional markets, like the U.K., growing from 4% to an estimated 24% share this year at the expense of Booking.com.

Valuation:

Commentary on valuation and other thoughts to come next week, but as an overview:

Needless to say, we are long!