Founded in 1962, Vail Resorts (“MTN”) has grown from modest beginnings to become the world’s leading mountain operator, managing 42 resorts globally and commanding a 20% share of North America’s ski market. The launch of the Epic Pass in the 2008-09 season revolutionized the industry, turning a traditionally volatile, weather-dependent business into a more predictable one. Today, 65% of Vail's lift revenue is secured before the ski season even begins.

The Portfolio

Vail Resorts operates 42 premier mountain destinations across three continents, including iconic names such as Vail, Whistler Blackcomb, and Park City. Renowned for their stunning landscapes, cutting-edge facilities, and diverse offerings, these resorts cater to both avid skiers and those seeking non-skiing adventures.

Epic Pass: Transforming the Ski Industry

The Epic Pass revolutionized the ski industry by offering access to 42 global resorts with no blackout dates. Before its launch, the industry’s reliance on consistent snowfall created significant financial uncertainty. By introducing an affordable, all-access season pass, Vail Resorts disrupted traditional lift ticket pricing, democratized skiing, and attracted a broader audience while ensuring more predictable revenue streams. Beyond transforming pricing, the Epic Pass strengthened offseason engagement, streamlined operations, and redefined resort marketing and customer relationships, turning skiing into a more accessible and lifestyle-oriented experience.

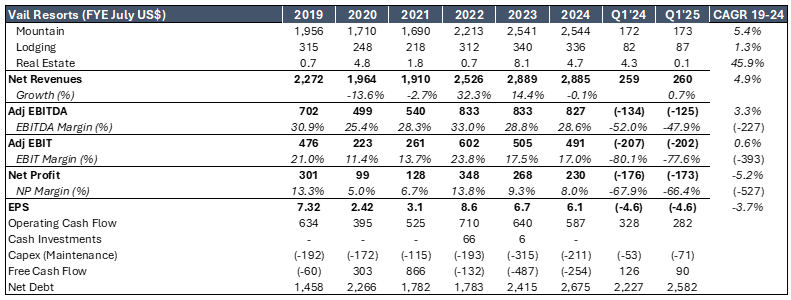

Financial Performance

Vail Resorts has delivered robust financial performance, achieving a ~5% revenue CAGR from 2019 to 2024. Mountain lift revenue, driven by the success of the Epic Pass, grew even faster, with an 8.6% CAGR from 2018 to 2024. Revenue per skier visit has also steadily increased, exceeding pre-COVID levels to reach $145—a testament to the company’s ability to boost guest spending and capitalize on high-demand services.

Investment Thesis

Duopoly Market Structure

Vail has expanded its market share of North American skier visits from 13.6% in 2016 to 20.2% in 2024, significantly outpacing its primary competitor, Alterra Mountain Company, at 11%. Over this period, Vail’s ski visitor base grew at an impressive ~7% CAGR, far exceeding the North American average growth rate of 1.7%.

By utilizing its scale, Vail consolidates the fragmented ski resort industry, acquiring and integrating premier destinations into its Epic Pass network. This strategy enhances operational efficiencies, ensures a consistent guest experience, and reinforces strong pricing power. With substantial opportunities for domestic consolidation and global expansion still in its early stages, Vail’s scale and strategic approach position it for sustained growth and long-term success in the highly seasonal ski market

Scale Benefits

Vail Resorts' significant scale drives operational efficiencies and strong pricing power in a fragmented industry with high barriers to entry. Owning many premier mountains in North America, Vail benefits from the scarcity of new destination ski resorts. From 2018 to 2024, Vail grew its pass revenue at a 15% CAGR, with pass revenue rising from 47% to 65% of Mountain revenue. Vail's irreplaceable assets and brand name solidify its leadership in the ski industry.

Resilient Business

Vail Resorts demonstrates remarkable resilience, consistently delivering revenue and profit growth over the years. Even during the COVID-19 pandemic, the company remained cash flow positive. Over the past decade, Vail has maintained positive net income and cash flow, further highlighted by a substantial improvement in its financial flexibility. The Capex+Debt/Operating Cash Flow ratio decreased from ~75% in 2018 to approximately 45% in 2024.

Key Risks

Climate Uncertainty: The Biggest Risk Facing Ski Resorts Today

Global warming is increasingly impacting ski resorts, with artificial snow reliance driving water consumption up from 300 million to 540 million liters by the end of the century. Climate change has already cost the U.S. ski industry over $5 billion, with ski seasons shortened by an average of 5-7 days since the 1960s-70s, resulting in $252 million in annual economic losses. Projections suggest further shortening of 14-62 days by the 2050s, potentially doubling or quintupling these losses if emissions aren't reduced in line with the Paris Climate Agreement.

Despite efforts to mitigate its impact, snowfall continues to affect revenue and profitability. In fiscal 2024, Vail Resorts experienced a 9.5% decline in skier visits due to poor snowfall, which was 28% below the prior year in North America and 44% below the 10-year average in Australia, leading to a $10 million EBITDA decline in the region. While the company depends on season passes for revenue stability, inadequate snowfall still disrupts ancillary spending. Additionally, inconsistent snowfall shortens the ski season, increasing operational costs and forcing resorts to adjust pricing and promotional strategies.

Dividends:

Vail Resorts currently pays a quarterly dividend of $2.22 per share, totalling $8.88 annually. A payout ratio of >140% leaves the dividend at risk and poor seasons such as in 2021, might lead to dividend reductions or suspensions.

Customer Satisfaction and Reputation

Vail Resorts has been plastered all over the news recently due to a strike by its Ski Patrollers in Park City in the middle of the peak Christmas Travel season. This and other instances of overcrowding at the ski lifts, has led to a Net Promoter Score (NPS) of -24!

Paraphrasing Kerrisdale this is not investment advice, and “is provided to you solely for your own entertainment purposes”.